What is the Great Australian Dream?

The Great Australian Dream is a belief that in Australia, home ownership can lead to a better life and is an expression of success and security.

The typical Australian Dream home embraces the idea of a free-standing house on a quarter acre suburban block, featuring a Hills Hoist and a barbecue.

History

The origin of the Great Australian Dream dates back to the period following World War II, which marked the beginnings of a new era for Australia. With economy on the mend, things started looking up thanks to the removal of rent controls, expansion of the manufacturing industry and low unemployment rates.

At that time, the ‘dream’ of buying a single storey house on a quarter acre block was not just a dream, but a very attainable reality. These days… not so much.

Current Situation

The rising prices of real estate have made it increasingly difficult to achieve the Great Australian Dream, especially for those living in large cities and the generation of Millennials (people born between 1980-1996). Baby boomers, on the other hand, have enjoyed the significant appreciation of house prices, which contributed to their wealth creation.

This obvious generational dissimilarity has become the focal point of many internet jokes and memes, sparking a tongue-in-cheek rivalry between the Baby Boomers and the Millennials.

Why does the Great Australian Dream seem so far out of reach in 2021?

There are many different factors that can influence the population’s purchasing power.

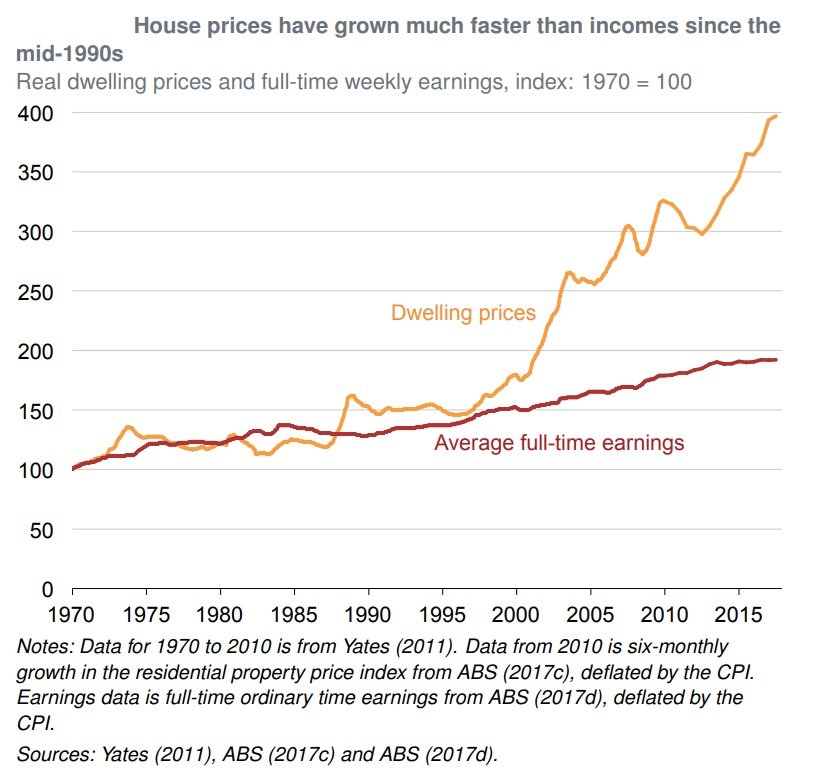

One of the main contributors to the home-buying affordability (or a lack thereof) nowadays compared to a few decades ago, is the widening gap between property prices vs income.

Credit: Business Insider

According to a survey conducted by Mortgage Choice & Core Data, 9 in 10 prospective home buyers feel it’s hard to get into the property market and over 50% of Australians believe the ‘traditional’ Australian Dream is no longer relevant.

That is why more and more astute investors started exploring other asset classes to provide them with capital growth, without all the high entry costs that are usually associated with real estate. Investing into cryptocurrency or ETFs has become the preferred option by many, especially younger-aged demographics.

—

Deakin University’s Head of Economics, Professor Pasquale Sgro says we’re only beginning to see the impact of the millennial philosophy of life.

“The next generation will build wealth, but they won’t do it via housing. They are better educated than their parents, so although they may appear frivolous at times, I’m sure they will wind up with more than just Instagram snaps of their travels. Gen Y is mobile and more entrepreneurial, which means they are likely to use their skills for start-ups and invest in business ventures.”

– Prof. Pasquale Sgro

Economist Brian Haratsis suggests that Millennials shouldn’t rule out owning a home entirely, but it may take longer to get into the market than it has in the past.

Home deposits being the biggest issue, Haratsis argues that we’re in need of a significant property policy overhaul, spotlighting the Western Australia’s shared home ownership scheme (the government gets 25% of the property when it sells, but it lowers the upfront costs and monthly loan repayments, making home-buying affordable for more people).

Is the Great Australian Dream dead?

No, it’s not dead. But it sure is evolving.

When you think about it, this world has developed at a massive speed in just the last two to three decades. Everything about the way we talk, live and work has changed, and we’ve rolled with it. Our definition of what it is to be wealthy will change as well.

Nonetheless, culturally and socially, we’ve been sold on the idea of owning a house as a security, which is still a prevailing belief these days (for now). People are still dreaming of owning a house, they just use different, more innovative ways to achieve this goal. For example:

- Rentvesting – renting a property that is right for their lifestyle and owning an investment property suitable for their budget in an area where they could afford to buy

- Buying an apartment instead of a house – to get ‘a foot in the door’ of the property market

- Progressive upgrading – buying a small and affordable home at first and ‘progressively upgrading’ into bigger and better properties over the years

- Moving further from the city – buying in suburbs further away from the city because they are more affordable

In conclusion, it’s evident that the need for becoming ‘money smart’ has significantly increased among the younger Australian population.

What has worked for our parents (“Get a good education, get a good job, you’ll be fine.”-approach) no longer applies these days, forcing young Aussies to think outside the box when it comes to their own wealth creation.

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” – Charles Darwin

Facebook Comments